Subrecipient Monitoring & Risk Assessment Guidelines

Responsible Offices: Sponsored Projects Accounting/Office of Sponsored Research Services

Effective Date: December 26, 2014

Revision Date: April 2023

Overview and Key Concepts

The purpose of this document is to communicate Washington University’s (University) updated guidelines for the programmatic and financial monitoring of its sponsored research subrecipients. A subrecipient is a third-party legal entity performing a portion of a University sponsored project or program (e.g. institution of higher education, hospitals, other non-profit entities, for-profit corporations and international organizations / institutions). The terms of the relationship are documented in a subaward/subcontract. In accordance with 2 CFR 200.332, these guidelines are intended to assist responsible faculty and staff in ensuring that the subrecipient is conducting its portion of the sponsored activity in compliance with laws, regulations and award and subaward / subcontract terms and conditions and that the subrecipient’s portion of the costs of the project are reasonable and allowable for the work activities completed.

This document also provides the University’s procedures for prospective risk assessment of subrecipients. Additional monitoring and reporting requirements may be required of the Principal Investigator (PI) or the Department Administrator (DA) depending on which of the three risk levels of “Low,” “Medium,” and “High” have been assigned to the collaborating subrecipient. In all instances good documentation of such monitoring activities should be maintained by the department and the PI. PI(s) and DA(s) should contact the OSRS office (wucontracts@wusm.wustl.edu) if they have any concerns about the technical progress or any financial inconsistencies on the part of the subrecipient.

Summary of Roles

| Principal Investigator (PI) or Designee | Department Administrator (DA) | OSRS | SPA |

|---|---|---|---|

| -Monitors technical progress of subrecipient | -Reviews invoices for reasonableness | -Issues subaward & applicable terms and conditions based on risk level | -Performs risk assessment, subrecipient monitoring, and desk checks in accordance with the risk level |

| -Reviews invoices for reasonableness | -Primary liaison between central offices and PI | -Primary contact for DA(s) & PI(s) for concerns with subrecipients and will coordinate with other central offices and parties as needed | -Resource for DA training on invoice review |

| -Monitors financial data and approves invoices | -Notifies OSRS of any concerns as needed | Manages encumbrances (supplier contracts) in Workday, including close-out | |

| -Notifies OSRS of any concerns as needed | -Make vendor vs. subrecipient determination and contact OSRS as needed |

Risk Assessment

In accordance with 2CFR Part 200.331(6)(b), Sponsored Projects Accounting (SPA), in conjunction with the Office of Sponsored Research Services (OSRS), will perform an evaluation of risk to determine a risk level. In December 2014 the UG Subrecipient Taskforce established the criteria by which to determine the level of risk as documented in the “Subrecipient Risk Assessment Decision Process.”

Additional Factors/Considerations which may result in a change in Risk Level

- Length of working relationship and/or previous experience with entity

- Scope of the project

- A negative response to the annual SUBSYSTEM SUBRECIPIENT MONITORING QUESTIONS

- Audit Findings

- Other

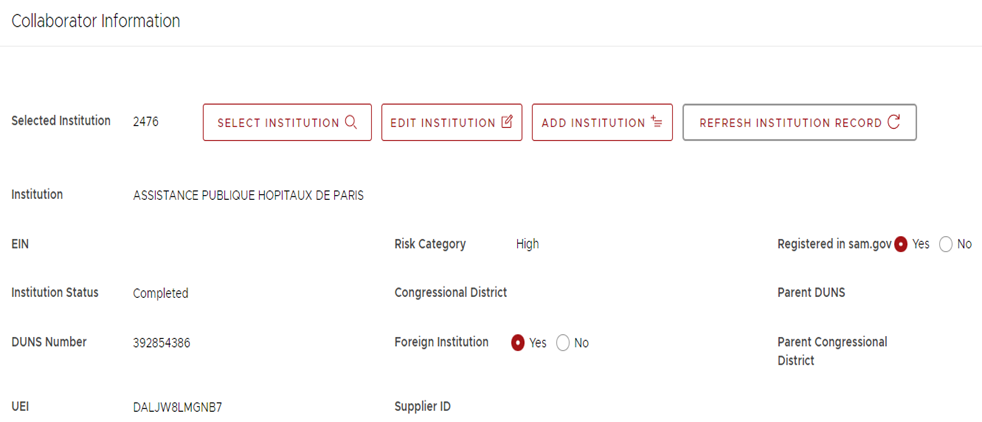

Departments may view the risk level assigned to subrecipient entities via the SUBS system (see screenshot below).

Procedures

OSRS will incorporate into the subaward modified Attachment 2 Terms and Conditions based on the risk assessment level.

- LOW RISK Entities: No changes to current terms and conditions

- MEDIUM RISK Entities: Potential additional items:

- Detailed budget including typical functional expense categories and indirect costs to be included in subagreement.

- Additional statement in Attachment 2 requiring the submission of detailed supporting data for amounts invoiced.

- Additional statement in Attachment 2 requesting the acknowledgement of training material review.

- HIGH RISK Entities: Potential Additional items:

- Subrecipient monitoring discussion with PI, OSRS, DA and SPA (meeting or call)

- Detailed budget including typical cost categories, including direct and indirect costs to be included in subagreement.

- Additional statement in Attachment 2 requiring additional invoicing backup detail to accompany invoices.

- Additional statement in Attachment 2 requesting acknowledgement of training material review.

- Optional

- Desk check audits to be scheduled by SPA as needed

- Invoice audits to be scheduled by SPA

- More frequent or detailed reporting to the PI may be required

- Other to be determined as deemed necessary

Monitoring Procedures

Technical Progress, Reports and Deliverables – The PI is responsible for monitoring the progress of the subrecipient work scope, using a variety of means to make this determination. This review should be performed on a continuous basis throughout the subagreement period of performance.

The PI might receive informal progress reports via phone conversations, e-mail communications, or face-to-face discussions with the collaborator and his/her staff at the subrecipient institution. Formal technical performance reports and/or deliverables may be required, and this data should be reviewed and evaluated by the PI. Unusual or unforeseen items/issues derived from this process should be investigated by the PI. The technical/progress reports should be retained on file within the PI’s department for ready access by regulators.

Principal Investigator concerns regarding the technical progress of the project, personnel at the collaborating institution/entity and/or other matters related to the subagreement must be brought to the immediate attention of OSRS and/or SPA.

Deliverables for Milestone or Fixed Fee Agreements – The PI should monitor/determine that all goals/milestones/receivables of the project are progressing at the agreed upon rate of time and withhold payment accordingly.

Invoices from the subrecipient for deliverables that have been submitted to WU for payment should contain a minimum level of information (based upon the terms in the agreement) including but not limited to:

- Name of subrecipient (e.g. letterhead of institution/entity)

- WU Subaward Number and Purchase Order (cost reimbursable subawards)

- Date of Invoice

- Period of Performance covered by invoice

- Final invoice for the project must be marked “Final”

- Description of the deliverables performed/provided

- Signature of institutional official (e.g., individual from accounting, finance, sponsored projects accounting…)

- Certification statement as to the truth and accuracy of the data on the invoice

- Contact person with respect to the invoice (e.g., name, e-mail address and phone number)

Review of Invoices and Expenses-to-Budget – For cost-reimbursement subagreements, subrecipient’s invoices should provide both current period and cumulative expenses-to-date. The DA, with input from the PI as necessary:

- Should compare subrecipient invoices to subaward budget to ensure that amounts invoiced appear reasonable based upon the technical progress of the project

- Are within the budget parameters and subaward performance period

- Are consistent and timely

Invoices from the subrecipient that have been submitted to WU for reimbursement should contain a minimum level of information (based upon the terms in the agreement) including but not limited to:

- Name of subrecipient (e.g. letterhead of instituion/entity)

- WU Subaward Number

- Date of Invoice

- Period of Performance covered by invoice

- Final invoice for the project must be marked “Final”

- Description of services reflected by billing (e.g. major expenditure categories)

- Current and cumulative period costs

- Signature of institutional official (e.g., individual from accounting, finance, sponsored projects accounting…)

- Certification statement as to the truth and accuracy of the data on the invoice

- Contact person with respect to the invoice (e.g., name, e-mail address and phone number)

Examples of subrecipient invoices with sufficient data are provided in Appendix B.

Clarification of Invoiced Charges – The DAs should request explanations for any “unusual”,”miscellaneous”, “other” or apparently excessive charges invoiced by the subrecipient. If the explanations provided by the subrecipient are not sufficient to render a prudent judgment on the allowability of the cost, the DA may request detailed justifications and/or supporting documentation from subrecipients. DAs may also periodically request, particularly from high-risk subrecipients (see risk-based criteria), detailed support for selected invoiced charges to verify their appropriateness and reasonableness. Examples of detailed justifications that may be requested from subrecipients are:

- Payroll records/data

- Copies of paid invoices showing the cost of items purchased and Vendor Justification Forms if required by Federal contract

- Descriptions of services rendered by consultants including hourly rates and time reports

- Detail of travel charges incurred stating the purpose, airfare, meals, lodging, ground transportation, unallowables, etc.

A list of invoice review items/questions is provided in Appendix C.

Costs determined to be unallowable or unreasonable should be disallowed and deducted/off-set from current or future invoices. Department Administrators may contact SPA for assistance in these matters. In circumstances where questionable costs remain unresolved, it may become necessary to conduct more definitive monitoring procedures. In these cases, Department Administrators should contact SPA to coordinate these subsequent actions.

- On-site Visits: On-site visits are a discretionary monitoring procedure. On-site visits conducted by the PI to evaluate both compliance with the scientific objectives of the project and the appropriateness of the subrecipient’s administrative systems, processes, and charges should be documented via correspondence, meeting notes, trip reports, etc. and retained on file.

- Audits: Discretionary desk audits of subrecipients are an acceptable monitoring procedure under Federal regulations and/or applicable “right to audit” clauses in the University’s subaward/subcontract agreements. Formal “on-site “audits are performed infrequently, however, and departments should contact SPA for assistance and coordination.

Invoices should not be approved for payment until all issues or concerns have been resolved.

Annual Subrecipient Audit Verification – On an annual basis, SPA will perform follow up risk assessment to identify any circumstances which would merit a change in the risk designation. This process includes verifying that the subrecipient organization has completed its 2 CFR Part 200 Subpart F – Audit Requirements (formerly OMB Circular A-133), as applicable. The audit will be reviewed on the Federal Audit Clearinghouse and if it is not available for review the subrecipient will be asked to complete an assessment document. The assessment document is available in Appendix D.

SPA will monitor and review the audit reports and the responses from the subrecipients. In the event that SPA has concerns about the audit report or the corrective action plan, the subrecipient will be contacted to resolve those issues. If the subrecipient does not respond to SPA’s concerns in a timely manner, future and/or final payments on any current agreement may be withheld. SPA will communicate and seek assistance from the DA/PI/OSRS to resolve the issue, as necessary.

Additional Considerations

Vendor vs Subrecipient Designation

In general, the determination of whether the proposed interaction with an entity should be as a vendor or subrecipient is apparent from the nature of the proposed endeavor and is determined primarily by the department. In the event that such a determination is unclear the checklist in Appendix A may be used in addition to consultation with the Office of Sponsored Research Services

De minimus Rate

The deminmus rate of 10% should be provided to all subrecipients that do not have a federally negotiated indirect cost (IDC) rate. NIH has received a deviation from this policy and will continue to cap IDC rates 8% for international subrecipients. Concerns or questions with regards to implementing this should be directed to SPA.

Responsible Office Contact

Joseph M. Gindhart

Associate Vice Chancellor for Finance & Sponsored Projects Accounting

(314) 935-7089

jgindhart@wustl.edu

Questions concerning subawards or subrecipients should be directed to:

Connie Motoki

Manager, Office of Sponsored Research Services

(314) 747-5272

motokic@wustl.edu

Questions concerning the Subrecipient Risk Assessment status, designation monitoring should be directed to:

Meredith Fey

Senior Grants Specialist, Sponsored Projects Accounting

(314) 935-7216

meredithfey@wustl.edu